| 1. | (a) | A company produces a product X, using raw materials A and B. The standard mix of A and B is 1 : 1 and the standard loss is 10% of input. You are required to compute the missing information indicated by "?" based on the data given below: | A | B | Total | Standard price of raw material (Rs./kg)

Actual input (kg.)

Actual output (kg.)

Actual price Rs./kg

Standard input quantity (kg.)

Yield variance (sub usage)

Mix variance

Usage variance

Price variance

Cost variance | 24

?

30

?

?

?

?

?

0 | 30

70

?

?

?

?

?

?

? |

?

270(A)

?

?

?

1300(A) |

| 14 | (0) |

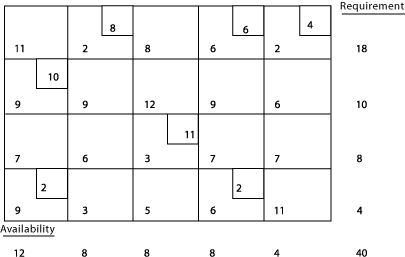

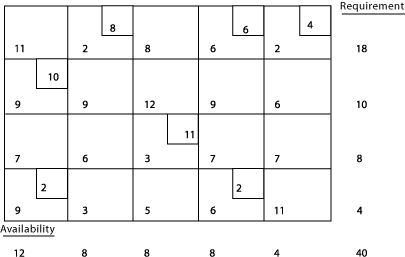

| | (b) | The initial allocation of a transportation problem, along with the unit cost of transportation from each origin to destination is given below. You are required to arrive at the minimum transportation cost by the Vogel’s Approximation method and check for optimality. (Hint: Candidates may consider u1 = 0 at Row 1 for initial cell evaluation)  | 6 | (0) |

| | (c) | How does the JIT approach help in improving an organisation's profitability? | 4 | (0) |

| 2. | (a) | A company has produced 1,500 units against a budgeted quantity of 2,000 units. Actual sales were 1,300 units. The company's policy is to value stocks at standard absorption cost. Other data are: Direct material

Direct labour

Variable OH

Fixed OH at budgeted capacity

Variable selling OH

Budgeted fixed selling OH

Actual fixed selling OH

Selling price | Rs. 100 per unit

Rs. 100 per unit at normal efficiency

Rs. 50 per unit

Rs. 1,00,000

Rs. 26,000

Rs. 30,000

Rs. 25,000

Rs. 400 per unit |

There was no opening stock. | (i) | Present the profitability statement under absorption costing system. | | (ii) | Assuming actual labour was 25% below normal efficiency and that 100 units of production had to be scrapped after complete manufacture, compute the actual profit or loss. | | (iii) | Reconcile the profits under (i) and (ii) above. |

| 11 | (0) |

| | (b) | What is product life cycle costing? What are the costs that you would include in product life cycle cost? | 4 | (0) |

| | (c) | The following information of a company is available for the year 2006: | Rs. | Sales

Raw materials

Direct Wages

Variable and fixed OH

Profit

Units sold | 40,000

20,000

6,000

10,000

4,000

200 Nos. |

In the year 2007, wages rate will increase by 50% and fixed cost will decrease by Rs. 600. If 300 units are sold in 2007, the total fixed and variable OH will be 11,400. How many units should be sold in 2007, so that the same amount of profit per unit as in year 2006 may be earned? | 4 | (0) |

| 3. | (a) | A company had planned its operations as follows: | Activity | Duration (days) | 1 — 2

2 — 4

1 — 3

3 — 4

1 — 4

2 — 5

4 — 7

3 — 6

5 — 7

6 — 8

7 — 8 | 7

8

8

6

6

16

19

24

9

7

8 |

| (i) | Draw the network and find the critical paths. | | (ii) | After 15 days of working, the following progress is noted: | (a) | Activities 1–2, 1–3 and 1–4 completed as per original schedule. | | (b) | Activity 2–4 is in progress and will be completed in 4 more days. | | (c) | Activity 3–6 is in progress and will need 17 more days to compete. | | (d) | The staff at activity 3–6 are specialised. They are directed to complete 3–6 and undertake an activity 6–7, which will require 7 days. This rearrangement arose due to a modification in a specification. | | (e) | Activity 6–8 will be completed in 4 days instead of the originally planned 7 days. | | (f) | There is no change in the other activities. |

Update the network diagram after 15 days of start of work based on the assumption given above. Indicate the revised critical paths along with their duration. |

| 11 | (0) |

| | (b) | Explain briefly the major components of a balanced score card. | 4 | (0) |

| | (c) | Describe the process of zero–base budgeting. | 4 | (0) |

| 4. | (a) | A gear manufacturing company makes two types of gears — A and B. Both gears are processed on 3 machines, Hobbing M/c, Shaping M/c and Grinding M/c. The time required by each gear and total time available per week on each M/c is as follows:

Machine | Gear (A)

(Hours) | Gear (B)

(Hours) | Available

Hours | Hobbing M/c

Shaping M/c

Grinding M/c

Other data:

Selling price (Rs.)

Variable cost (Rs.) | 3

5

2

820

780 | 3

2

6

960

900 | 36

60

60 |

Determine the optimum production plan and the maximum contribution for the next week by simplex method. The initial table is given below: | | Qty\C1 | 40 | 60 | 0 | 0 | 0 | | C1 | Variable | | x1 | x2 | x3 | x4 | x5 | | 0 | x3 | 36 | 3 | 3 | 1 | 0 | 0 | | 0 | x4 | 60 | 5 | 2 | 0 | 1 | 0 | | 0 | x5 | 60 | 2 | 6 | 0 | 0 | 1 |

| 7 | (0) |

| | (b) | What are the essential requirements for successful implementation of TQM? | 6 | (0) |

| | (c) | A company makes 1,500 units of a product for which the profitability statement is given below: | Rs. | Sales

Direct materials

Direct labour

Variable OH

Subtotal variable cost

Fixed cost

Total cost

Profit |

30,000

36,000

15,000 |

81,000

16,800 | 1,20,000

97,800

22,200 |

After the first 500 units of production, the company has to pay a premium of Rs. 6 per unit towards overtime labour. The premium so paid has been included in the direct labour cost of Rs. 36,000 give above. You are required to compute the Break–even point. | 6 | (0) |

|

| 5. | (a) | A research project, to date, has cost a company Rs. 2,50,000 and is under review. It is anticipated that should the project be allowed to proceed, it will be completed in about one year and can be sold for Rs. 4,00,000. The following additional information is available: | (i) | Materials have just been received for Rs. 60,000. These are extremely toxic, and if not used in the project, have to be disposed of by special means at Rs. 15,000. | | (ii) | Labour: Rs. 75,000. The men are highly skilled. If they are released from the Research Project, they may be transferred to the Works Department of the company and consequently the sales could increase by Rs. 1,50,000. The accountant estimates that the prime cost of those sales would be Rs. 1,00,000 and the overhead absorbed (all fixed) would amount to Rs. 25,000. | | (iii) | Research staff: Rs. 1,60,000. A decision has already been taken that this will be the last major piece of research undertaken and consequently, when work on the project ceases, the staff involved will be made redundant. Redundancy and severance pay have been estimated at Rs. 25,000. | | (iv) | Share of General Building Expenses : Rs. 35,000. | | The Managing Director is not sure what is included in this amount, but the accounts staff charge similar amounts each year to each department. |

You are required to advise whether the project should be allowed to proceed and explain the reasons for the treatment of each of amounts above in your analysis. | 10 | (0) |

| | (b) | Discuss with examples, the basic costing methods to assign costs to services. | 5 | (0) |

| | (c) | Discuss the application of the learning curve. | 4 | (0) |

| 6. | (a) | Hardware Ltd. manufactures computer hardware products in different divisions which operate as profit centres. Printer Division makes and sells printers. The Printer Division's budgeted income statement, based on a sales volume of 15,000 units is given below. The Printer Division's Manager believes that sales can be increased by 2,400 units. If the selling price is reduced by Rs. 20 per unit from the present price of Rs. 400 per unit, and that, for this additional volume, no additional fixed costs will be incurred. Printer Division presently uses a component purchased from an outside supplier at Rs. 70 per unit. A similar component is being produced by the Components Division of Hardware Ltd. and sold outside at a price of Rs. 100 per unit. Components Division can make this component for the Printer Division with a small modification in the specification, which would mean a reduction in the Direct Material cost for the Components Division by Rs. 1.5 per unit. Further, the Component Division will not incur variable selling cost on units transferred to the Printer Division. The Printer Division's Manager has offered the Component Division's Manager a price of Rs. 50 per unit of the component. Component Division has the capacity to produce 75,000 units, of which only 64,000 can be absorbed by the outside market. The current budgeted income statement for Components Division is based on a volume of 64,000 units considering all of it as sold outside. | Printer Division | Component Division | | Rs. '000 | Rs. '000 | Sales revenue

Manufacturing cost:

Component

Other direct materials, direct

labour and variable OH

Fixed OH

Total manufacturing cost

Gross margin

Variable marketing costs

Fixed marketing and Admn. OH

Non–manufacturing cost

Operating profit | 6,000

1,050

1,680

480

3,210

2,790

270

855

1,125

1,665 | 6,400

—

1,920

704

2,624

3,776

384

704

1,088

2,688 |

| (i) | Should the Printer Division reduce the price by Rs. 20 per unit even if it is not able to procure the components from the Component Division at Rs. 50 per unit. | | (ii) | Without prejudice to your answer to part (i) above, assume that Printer Division needs 17,400 units and that, either it takes all its requirements from Component Division or all of it from outside source. Should the Component Division be willing to supply the Printer Division at Rs. 50 per unit? | | (iii) | Without prejudice to your answer to part (i) above, assume that Printer Division needs 17,400 units. Would it be in the best interest of Hardware Ltd. for the Components Division to supply the components to the Printer Division at Rs. 50? | | Support each of your conclusions with appropriate calculations. |

| 12 | (0) |

| | (b) | What are the practical applications of Linear programming? | 7 | (0) |