| ... From Page 2 |

Balance Sheet - Fund Area + Current Area |

|

• Fund

Meaning

Synonyms = Finance, Support, Back, Furnish. • Current

Meaning

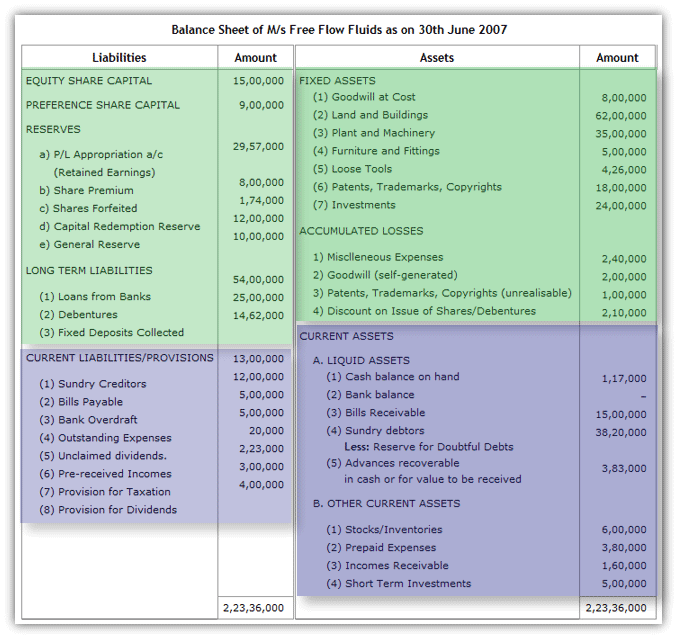

Synonyms = Present, Existing, Recent, In Progress. Consider the following Balance Sheet with rearranged figures (grouping Fixed Assets and Accumulated Losses).

An abridged version would look like this

• Fund/Current Liabilities/Assets

The Balance Sheet (both the assets side as well as the liabilities side) can be considered of being made up of two areas. The Fund Area and the Current Area. This classification is based on the time. The Current natured (having a life span of less than one year) assets and liabilities form part of the Current Area and the Long term Assets and Liabilities (including owned capital) form part of the Fund Area.

Thus we can say that the Balance Sheet is made up of

|

Working Capital - Residue of Current_Area/Fund_Area |

|

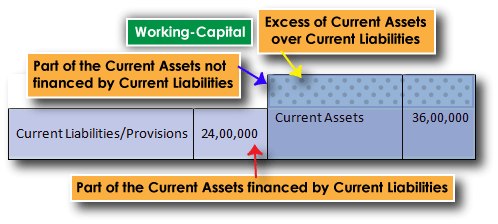

• Working Capital = Current Assets − Current Liabilities/Provisions [Residue of Current Area]

It is assumed that the Current Assets are as far as possible are financed by similar natured (i.e. current natured) liabilities. Only the additional finance/investment needed is derived from long term (Fund) liabilities.

Working Capital is

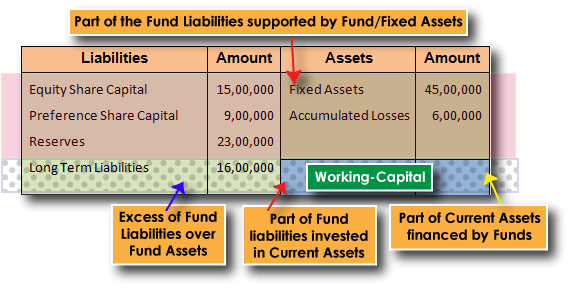

• Working Capital = Fund Liabilities − Fund Assets [Residue of Fund Area]

Fund Liabilities are assumed to be invested as far as possible in similar natured (i.e. fund natured) assets. Only the remaining would be invested in Current natured assets.

Working Capital is

|

What additional information is derived from this? |

|

|

The identification of the balance sheet as being made up of two areas i.e. the current area and the fund area does not in itself reveal any other quantitative information. It provides only qualitative information which enables us to have a better understanding of the balance sheet items and derive various interpretations for working capital.

This understanding on the two areas of the balance sheet would be most helpful when we start learning about funds flow in the subsequent notes. |

| Author Credit : The Edifier | ... Continued Page 4 |